Originally published in FIDE Forum’s ‘Forum Insights – Issue 03’, authored by CEO of CGC Digital, Yushida Husin.

Driven by digitalisation and advancements in big data, alternative data is increasingly being recognised for its potential to enhance traditional credit risk assessments and decisioning among financial service providers. In keeping pace with developments, FI boards should strive to develop a greater understanding of alternative data and its potential benefits and challenges, and cultivate an open-minded, informed approach towards implementing alternative data initiatives in their institutions.

The Emergence of Alternative Data in Financial Services

In recent years, the world has witnessed an exponential rise of the digital economy and enhancements in technologies ignited by the COVID-19 pandemic.

The accelerating drivers of this global digitalisation were widespread capture and storage of information on digital platforms and applications, which generated volumes of large-scale data, alongside generative artificial intelligence (AI) and machine learning (ML), sophisticated algorithms specifically designed to synthesise data and extract valuable insights. These trends have led to considerable transformations in the global financial services landscape. Significantly, within the banking sector, the proliferation of big data has prompted a turn to using non traditional or alternative forms of data to drive customer-centric insights, conduct risk assessments, and improve decision-making.

The figures alone tell the story of alternative data’s rise; in 2022, the global alternative data market size was valued at USD 4 billion[1]. On top of this, the global market for alternative data providers is poised to reach USD 156.23 billion by 2030, growing at a CAGR of 51.8% from 2022 to 2030, according to a 2023 report published by global research and consulting firm The Insight Partners[2].

What Is Alternative Data, and How Is It Being Used by Financial Service Providers?

Across the board, data serves several important core functions for financial service providers, including traditional financial institutions (FIs). Not only is access to data key to performing market research, user experience improvement, and business development, but it is also the backbone of day-to-day operations, decision-making and the key to enabling growth and competitiveness.

While traditional data sources have been utilised to their fullest, alternative data is growing increasingly popular among financial services players, owing to its extensive scope and potential to mine deeper information and insights.

In simple terms, alternative data refers to data that falls outside of traditional financial sources, including data from e-commerce platforms, payment partners, digital wallets, accounting systems, geolocation apps, websites and social media[3]. However, this is not an exhaustive list.

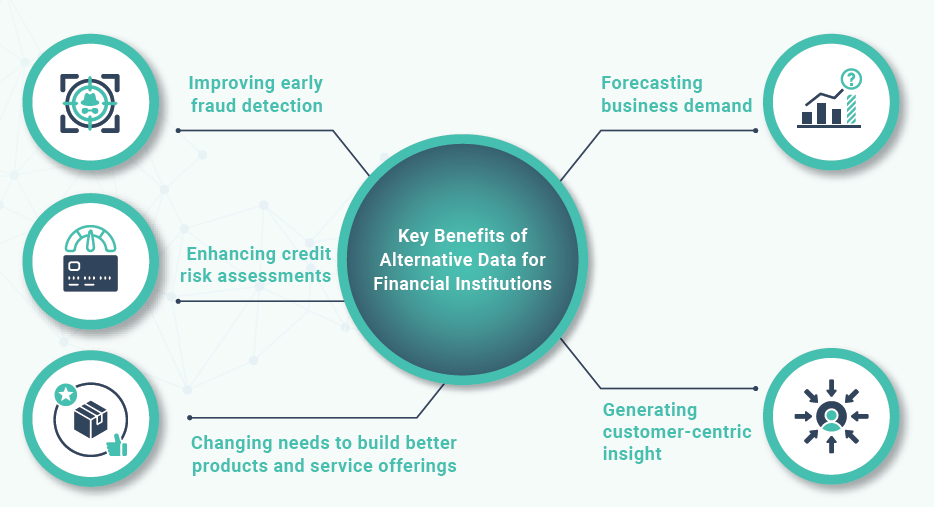

As an unstructured set of information, alternative data is continuously expanding in proportion to the volume of data produced in the digital world[4]. Its uses to financial

service providers are wide ranging: from improving early fraud detection and forecasting business demand, to enhancing credit risk assessments and generating customer-centric insights to identify gaps and changing needs to build better products and service offerings.

Alternative Credit Scoring in Banking: Global and Regional Use Cases

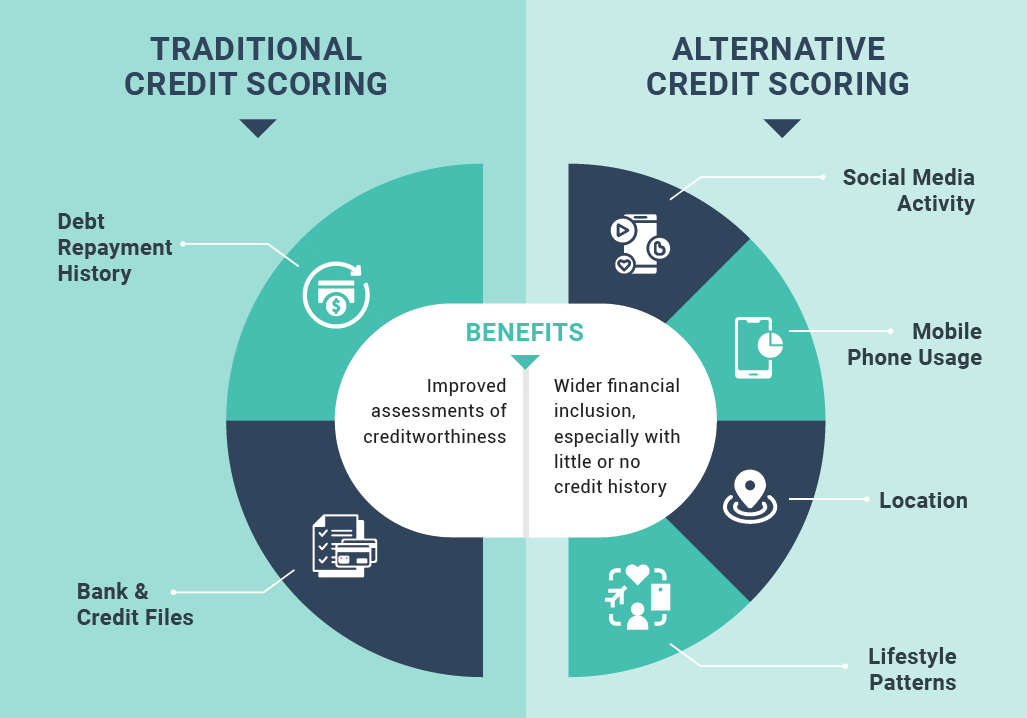

In the case of credit lending, alternative data can help with making more accurate assessments of a borrower’s creditworthiness. In essence, information from alternative sources (such as social media activity, mobile phone usage, location etc.) is analysed using AI and machine learning tools to generate insights into spending habits and patterns, as well as more qualitative or behavioural indicators, such as social interactions and lifestyle patterns[5].

Alternative credit scoring can help banks to form a more complete picture of the borrower’s risk profile when it comes to assessing the ability and propensity to repay their loans. In other words, alternative data augments traditional financial data (such as debt repayment history and bank and credit files) that most FIs already use to determine creditworthiness. This is especially useful when expanding access for ‘thin file’ applicants with little or no credit history[6].

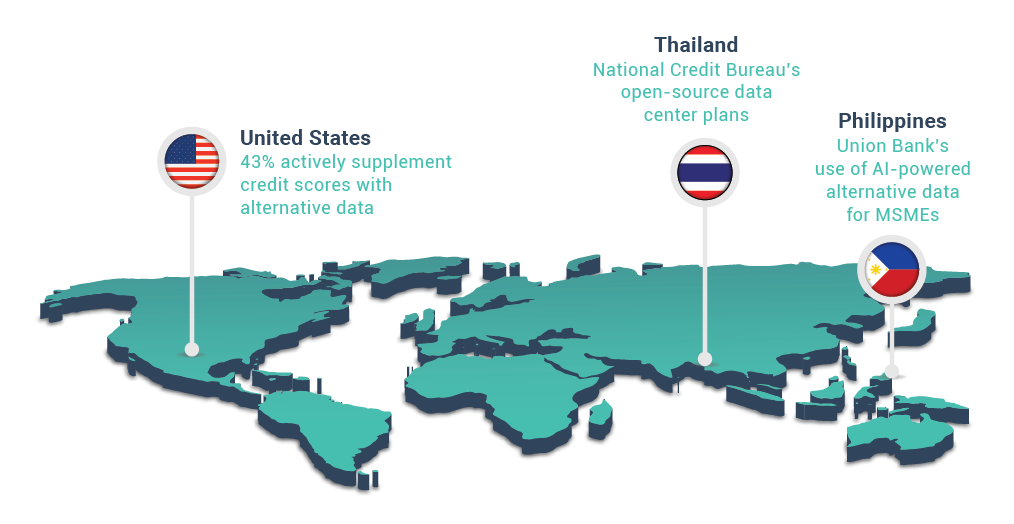

In the US, alternative data adoption is growing among financial service providers, with a majority using this data to enhance credit risk assessments. For example, in 2023, a nationwide survey of senior decision makers in US financial institutions revealed that at least two-thirds of respondents used alternative data in their credit risk assessments for underwriting and portfolio management, while 84% had used alternative credit data in prescreening and credit risk across the customer lifecycle[7]. Meanwhile, a 2024 survey conducted by Nova Credit revealed that 43% of lenders in the sample actively supplemented their credit scores with alternative data in their risk assessments, while 90% felt that access to alternative data would help improve their credit underscoring models[8].

Across Southeast Asia, several governments, banks and key stakeholders are also becoming increasingly interested in the potential of alternative data. In December 2022, the National Credit Bureau of Thailand announced a plan to launch an open-source data centre containing non-credit information such as consumers’ utility payments data. This data centre was envisioned as a source of alternative data for banks looking for another avenue of analysis to determine loan approvals for applicants, especially those from underserved populations. At the time, the NCB had also considered consolidating this data into its existing credit database[9].

In 2021, the Credit Information Centre (CIC), a public credit registry in the Philippines, announced plans for an open policy to enable accessing entities to utilise its credit bureau data with alternative data to create a complete picture of a borrower’s credit profile[10]. The country’s leading digital bank, UnionBank, uses alternative data and an AI-powered risk scoring solution to facilitate more efficient loan provision for unbanked individuals and MSMEs. Powered by machine learning, the solution considers non-traditional data from publicly available sources, government data and partners to assess creditworthiness more inclusively and accurately[11].

Why Should Malaysian Banks Care About Alternative Data?

Digital lending represented a significant driver of Southeast Asia’s USD 30 billion revenue from digital financial services in 2023 due to high lending rates and consumer demand, according to recent research by Google, Temasek and Bain & Company[12].

In Malaysia, the widespread public adoption of digital payment and e-commerce transactions has catalysed the generation of data with potential to add value and help drive better decision making for financial services providers. On top of this, MSMEs and small businesses, the key driving forces in the region’s economies, are increasingly participating in the digital economy.

With alternative data, banks can identify better creditworthy borrowers who may not meet traditional credit requirements and thus widen their customer base, while widening financial inclusion for the proportion of unbanked and underserved segments that may not meet traditional credit requirements.

Indeed, Malaysia’s central bank and financial institutions regulator, Bank Negara Malaysia (BNM), in its Financial Sector Blueprint 2022-2026, has emphasised the higher usage of “forward-looking and alternative data” as a main pillar of sustaining a strong economic recovery[13].

Instilling a Culture of Change From The Top

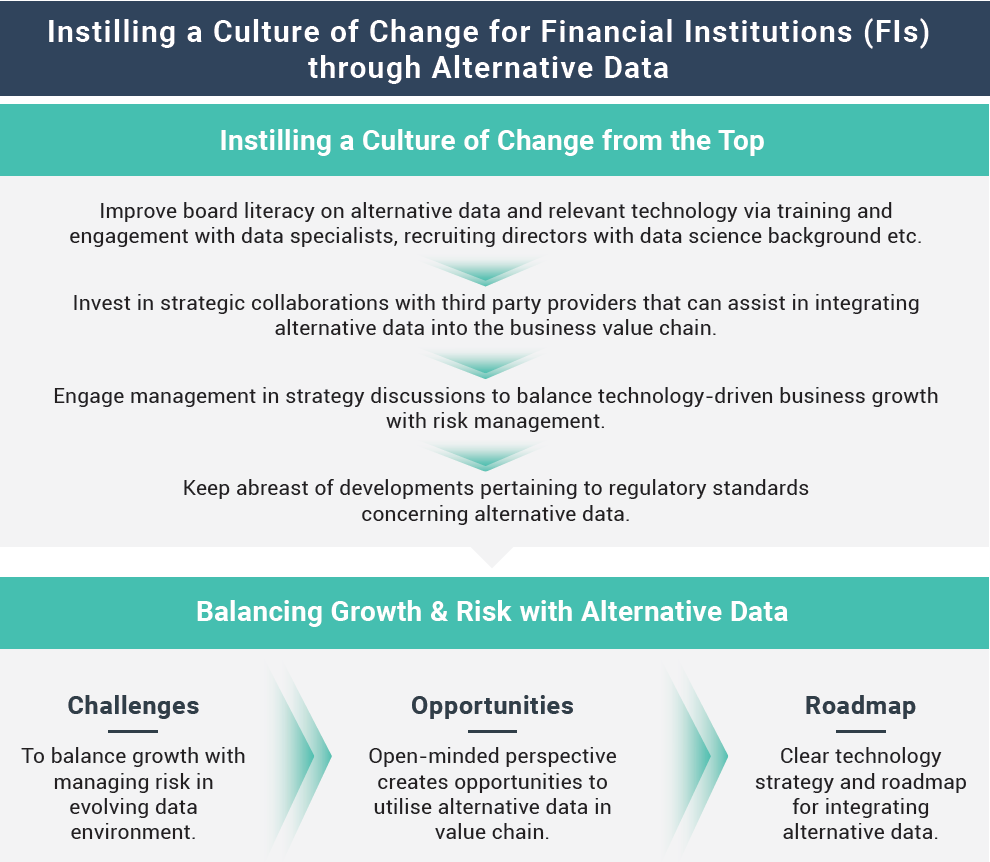

Adoption will not be a straightforward process, and FIs on the cusp of embarking on their alternative data journey may find it rather challenging to balance growth with managing risk prudently, especially since the environment is still evolving and in the early stages of maturity.

Nevertheless, organisations willing to embrace an open-minded perspective will be more likely to uncover and create opportunities to utilise alternative data in their value chain. Critically, a clear technology strategy and roadmap for integrating alternative data, which includes investing intelligently in digitalisation and tools to drive business growth, will be needed.

This trend underscores the fact that leveraging alternative data is as much about shaping the organisation’s collective mindset as it is a technological issue. In this regard, FI boards have a critical role in charting the course and setting forth clear and purposeful thought leadership for the organisation while providing guidance and oversight on which risks to embrace or avoid. Board risk committee members primarily represent the vanguard of boards for overseeing risk and providing a lens on whether a risk is more of a threat or an opportunity.

As a starting point, boards should collectively increase their literacy and understanding of alternative data and relevant cutting-edge technology tools to be better able to join up and understand risk and opportunity across functions and business lines. Such knowledge could be acquired, for example, through training and engagement with experts and data science specialists, collaboration with third party providers, and recruiting directors with a background in data science to be part of the board.

Once this knowledge base has been consolidated, boards will be better equipped to elevate their assessment of alternative data to a strategic level. In turn, this will allow them to engage management in discussions on how to integrate data to enhance the business value chain in an informed manner while also establishing procedures for risk management ahead of implementation.

On top of this, boards should also strive to keep abreast of developments pertaining to regulatory standards surrounding alternative data, even as the regulatory environment continues to evolve (see below).

Regional Trends in Alternative Data Regulations

Within ASEAN, the regulatory environment on data analytics is still evolving, though in recent years there have been signs of acknowledging the use of alternative data within certain jurisdictions:

- In 2018, Singapore’s Monetary Authority (MAS) published an information paper on the responsible use of AI and data analytics. Two years later, the government’s Smart National and Digital Government Office developed a National Artificial Intelligence (AI) Strategy detailing plans to increase the nation’s adoption of AI, alongside a model AI Governance Framework[15]. In 2023, as part of this National Strategy, MAS launched its Veritas Toolkit initiative, a multi-phased collaborative project with the financial industry, which put in place a framework for financial institutions to promote the responsible adoption of AI and data analytics, with the aim of driving fairness metrics in credit scoring and customer marketing[16].

- Another key movement is APIX, an initiative of the Asean Financial Innovation Network, a not-for-profit entity that was jointly formed by the MAS, the World Bank Group’s International Finance Corporation and the Asean Bankers Association in 2018. It is a global, open-architecture platform that supports FIs and Fintech firms to connect to one another in Asean markets and around the world[17].

- However, in other countries like Thailand and Indonesia, data analytics and governance regulations still focus largely on the areas of data protection and privacy. For example, while the Thai government has developed a Digital Government Plan to digitalise government agencies with the use of AI, and Indonesia has similarly put in place a national strategy for developing AI spanning the next two decades up to 2045[18], these regulations still focus mainly on the area of data protection and privacy, while the use of alternative data as a specific subset is arguably less emphasised.

Partnerships to Drive Alternative Financing: A Potential Game Changer

Besides providing strong leadership, FI boards that are looking to adopt alternative data for their institutions would do well to consider partnering with digital-first industry players already driving data and technology-driven innovations in the financial ecosystem. Such collaborations can help gain valuable support and assistance to stream alternative data into the business process effectively.

CGC Digital, the digital startup arm of Credit Guarantee Corporation focused on assisting MSMEs in accessing financing and scaling up their businesses through data-driven innovation, is one example of a fintech that has collaborated with other financial sector stakeholders to bridge the MSME funding gap by relooking how credit assessment is performed and using alternative data points to complement traditional assessments of creditworthiness.

To conclude, as FI boards look to the future of alternative data, the opportunity for first-mover advantage is wide open to those willing to embrace an open-minded perspective to acquire knowledge and forge strategic partnerships with like-minded industry players to harness the potential of alternative data. Adopting this mindset would be a game changer for FIs in creating a more resilient footprint and charting a course towards adopting alternative data in 2024 and beyond.

References:

- PricewaterhouseCoopers, “Beyond Traditional Data: Leveraging Alternative Data in Banking,” Financial Services Data and Analytics, April 2024,

https://www.pwc.in/consulting/technology/data-and-analytics/beyond-traditional-data-leveraging-alternative-data-banking.html - The Insight Partners, “Alternative Data Market Size and Forecast (2020-2030), Global and Regional Share, Trend and Growth Opportunity Analysis Report,”

accessed September 16, 2024, https://www.theinsightpartners.comreports/alternative-data-market. - PricewaterhouseCoopers, “Risk and Regulatory Outlook 2021: Key Developments in Southeast Asia: Use of Artificial Intelligence, Machine Learning and Alternative Data in

Credit Decisioning,” Banking Outlook in Southeast Asia, Risk and Regulatory Outlook, 2021, 8. - David Navetta, Michael Egan, and Nicolas H. R. Dumont, “Alternative Data – A COSO Perspective,” The Harvard Law School Forum on Corporate Governance (blog), April 23, 2024, https://corpgov.law.harvard.edu/2024/04/23/alternative-data-a-coso-perspective/.

- Visa Consulting & Analytics, “Sourcing New Data for Richer Credit-Risk Decisions,” n.d., https://corporate.visa.com/content/dam/VCOM/corporate/services/documents/vca-sourcing-new-data-for-credit-risk-vf.pdf.

- PricewaterhouseCoopers, “Risk and Regulatory Outlook 2021: Key Developments in Southeast Asia: Use of Artificial Intelligence, Machine Learning and Alternative Data in Credit Decisioning.”

- LexisNexis Risk Solutions, “2023 Alternative Credit Data Impact Report,” February 15, 2023.

- Nova Credit, “The State of Alternative Data in Lending 2024,” Survey Report (Researchscape, April 10, 2024), https://marketing.novacredit.com/hubfs/2024%20Pardot%20Migration/Reports/2404_Nova_Credit_The_State_of_Alternative_Data_in_Lending_Report.pdf.

- Somruedi Banchongduang, “Alternative Data Centre for Lenders Planned for next Year,” Bangkok Post, December 24, 2022, sec. Business, https://www.bangkokpost.com/business/general/2467915/alternative-data-centre-for-lenders-planned-for-next-year.

- Bianca Cuaresma, “CIC Eyes Alternative Data to Expand Credit Access | Bianca Cuaresma,” BusinessMirror, November 2, 2021, sec. Banking & Finance, https://businessmirror.com.ph/2021/11/02/cic-eyes alternative-data-to-expand-credit-access/.

- Nurdianah Md Nur, “Revolutionising Finance: Leveraging Alternative Data for Inclusion and Crime Prevention,” The Edge Singapore, December 4, 2023, https://www.theedgesingapore.com/digitaledge/digital-economy/revolutionising-finance-leveraging-alternative-data-inclusion-and-crime.

- Google, Temasek, and Bain, “E-COnomy SEA 2023,” n.d., https://services.google.com/fh/files/misc/e_conomy_sea_2023_report.pdf.

- Negara Malaysia, “Financial Sector Blueprint 2022-2026,” January 2022, https://www.bnm.gov.my/publications/fsb3.

- Bank Negara Malaysia.

- PricewaterhouseCoopers, “Risk and Regulatory Outlook 2021: Key Developments in Southeast Asia: Use of Artificial Intelligence, Machine Learning and Alternative Data in Credit Decisioning.”

- FinTech Global, “Singapore’s MAS Launches Veritas Toolkit 2.0 for Responsible AI in FinTech,” FinTech Global (blog), July 3, 2023, https://fintech.global/2023/07/03/singapores-mas-launches-veritas-toolkit-2-0-for-responsible-ai-in-fintech/.

- “World’s First Cross-Border, Open-Architecture Platform to Improve Financial Inclusion,” Government, September 17, 2018, https://www.mas.gov.sg/news/media-releases/2018/worlds-first-cross-border-open-architecture-platform-to-improve-financial-inclusion.

- PricewaterhouseCoopers, “Risk and Regulatory Outlook 2021: Key Developments in Southeast Asia: Use of Artificial Intelligence, Machine Learning and Alternative Data in Credit Decisioning.”